Gabbi knew that real estate was the right career from the start. She is now dual licensed in both Kentucky and Ohio. She had her first sale within a month of getting licensed and hit her first million in volume within her first 6 months. She will have her real estate license for the rest of her life. Call her anytime if you have questions about becoming a real estate agent. She loves to share her passion for real estate with others!

Am I Ready to Purchase My First Home?

What kind of credit score do you need to buy a house?

How do you know when it’s the right time to purchase?

So many questions come to mind when contemplating one of the largest financial decisions you'll make in your lifetime. While monitoring if home values are rising or falling are important metrics, the best time to buy a house is when you can afford it. Most buyers are ready if they have great credit, low debt, and a steady income.

Let’s first ask ourselves a few questions. Are you planning on staying in one area for 3-5 years? If that’s a no, then you should continue to rent. If that’s a yes, then it’s time to look into your finances and see if buying a house is a responsible decision.

Loan Officers

Once you know that you are staying in the area and you believe your finances are in a good place, the first thing you want to do is find a loan officer. The loan officer is going to be your guide for picking an appropriate price point and figuring out what monthly payments are going to be affordable for you. Read our article here on how to pick a loan officer. Your loan officer is going to review your debt, your credit, your income, and your income increase potential. They’ll gather paystubs, bank statements, and most likely contact your boss. It sounds intrusive, but it’s necessary to evaluate what the best decision is for you. Your goal is to work with a loan officer that is great at communicating, educating on different processes of loan underwriting, and getting you a great interest rate.

Interest Rates & Investments

What is interest on a home purchase and why is a low rate so important? The interest charged to the borrower, from the bank, is one way the bank will make money for loaning on the purchase (discount points and origination fees are a couple other examples). Even a small percentage change in the interest rate will have a large impact on the total amount the borrower will pay back over the life of the loan. Lucky for you, interest rates are historically low. Curious how a small change in interest rate affects a loan? Take a look at a few examples below.

$200,000 loan, 30 year term, all other variables left at 0:

- 3% interest rate

- Total amount paid back by borrower: $303,554.90

- 3.5% interest rate

- Total amount paid back by borrower: $323.312.18

- 4% interest rate

- Total amount paid back by borrower: $343,739.01

Why are low interest rates so important to you as a buyer?

A. You will owe the bank less money for borrowing.

B. You are being issued a mortgage at a fixed rate. This means that your interest rate is not going to rise and fall with the market.

C. If the life of your loan is for 30 years, your interest rate will stay the same but your salary will most likely increase within that time frame. More income with steady low debt is a good thing.

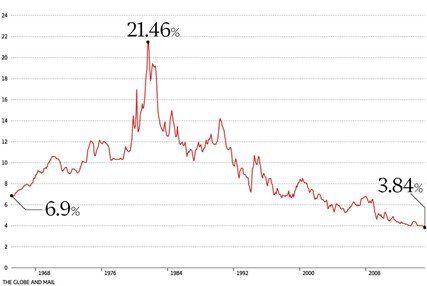

This is why people are comfortable with purchasing a house in the current climate at a premium price. Consumers are relying on the low interest rates to keep their monthly payments manageable. It’s what people call “cheap debt.” If done properly, it’s a good thing. Your principal payment is what you’re paying toward the equity of the house. You can shorten the life of your loan and decrease your interest owed by making additional payments toward your principal each month. If interest rates were what they were 10 years ago, that would be a priority for everyone because they would want to try to decrease the life of their loan. With the current interest rates, I would put that additional money into investments. Why? If you can make a return on your investments that is greater than your interest rate (2.5-3%), then your money should go into investments. The typical return for a basic index fund is 6% per year. See what I am getting at? To put the interest rates through the years in perspective here is a chart of historical rates:

My interest rate was 2.8% and I bought in January 2021. Can you imagine paying 21.46% interest? That money is a sunk cost, aka you will never see it again. It is painful to think about.

Another thing I want you to consider is the down payment. There is no set amount that is necessary for a typical price point. For any area there are going to be different taxes, different prices for homeowner’s insurance, and various loan fees. This is when having a great loan officer is crucial. If you have someone that does not have time to run case by case down payment options and monthly payments, then get a new loan officer that does. To read more on closing costs of a loan read our article here.

Real Estate Agents

Find yourself a great agent. A good agent is going to have time for you and they are going to take your calls and educate you throughout the process. Their biggest role is not to send you the link of the perfect house. Anyone has access to listings on the market. Their value is to determine the value of the homes you are looking at and guide you through the process so that you feel you can make informed decisions. They should have resources for you to choose from every step of the way. These resources should include dependable loan officers, experienced inspectors, and terrific title companies. These assets are going to make your buying experience a positive one. They are also going to look out for your best interests when they are negotiating on your behalf. If you’d like more instruction on how to find an agent read out article here.

If you read this article and you think you are ready, I want you to consider a few more items. You may have been approved for $350,000 but is that what you need? Take the time to print out all your credit statements. Go in with highlighter and figure out where you are spending your money. Are you going to bars? Are you buying clothes? Do you have really high car payments? Are these costs adding value to your life? Take the time to understand your finances!

Ask yourself these questions:

- Do I have outstanding debt or student loans that I am not prioritizing?

- Do I have a plan for retirement that I am contributing to each month?

- Do I have costs that I can cut or decrease?

- Am I paying for something that no longer brings me joy?

- Are my values shifting as I age? Can I align my spending to reflect that?

The reason I bring this up is because you are making a big purchase. You want it to be responsible and align with your budget and income. You shouldn’t use the maximum loan amount because you fell in love with a house. That is purchasing with your heart and emotion versus your mind and your wallet.

Spending Habits

You should be borrowing the amount that makes sense for your income and lifestyle. If you can’t give up golfing every weekend, then you need to purchase a home that’s manageable in combination with that cost. It might seem painful to take a look at all your spending habits but it’s going to set you up for future success. Getting older means taking responsibility for your future self. Buying a home can be a huge part in that process. Are you ready?

About the Author

Recent Posts

Let's Stay Connected

Follow us on and become part of the PREC community

Never miss a tweet by connecting with us on Twitter

Check our our posts about trends in real estate industry and market