Gabbi knew that real estate was the right career from the start. She is now dual licensed in both Kentucky and Ohio. She had her first sale within a month of getting licensed and hit her first million in volume within her first 6 months. She will have her real estate license for the rest of her life. Call her anytime if you have questions about becoming a real estate agent. She loves to share her passion for real estate with others!

The Importance of Real Estate in Building Wealth

Let’s start with the basics. You are 2-3 years into working and you are accumulating money and you want to do what’s best for your future. Before anything else, I would start by creating a cash emergency fund and then tackle any high-interest debt you might have.

Emergency Fund

An emergency fund is a safety net that you should accumulate in cash. It’s a very personal and situational fund. Its purpose is to protect you in case any big-ticket items come up unexpectedly or to protect you against job loss. You can use this money to pay your bills and take care of any financial windfalls when something happens unexpectedly. It is determined by how much you spend in a month to pay your bills and your skillset. For example, if you are in a very competitive field and finding a job would take you at least 3 months then you need to build up that emergency fund to cover 3 months of expenses. If you are in a skillset that is always in high demand, and you feel that you could find another job in one month then you would adjust your emergency fund accordingly. For example, a coder, or someone who has high credentials in tech is probably going to find a job faster than someone with a broader degree like communications, where it’s more competitive to find a job.

The general recommendation is at least 3 months. Once you get to that 3-month mark, don’t just leave it at that. Every year you should try to get another month ahead. By doing this you are going to build up a couple years’ worth of savings in this emergency fund so that you will have a lot saved up in cash by the time you retire. You should begin by thinking through how much you need and how much you spend each month so you can figure out what your monthly emergency fund needs to be and how long you’d need it to last you.

High-interest Debt

Once you’ve built up an emergency fund you will want to attack any high-interest debt. What do I mean by that?

- Credit card debt

- Student loans

- High-interest personal lines of credit

- High-interest equity lines of credit

My personal rule of thumb is anything above 5% needs to be taken care of first. That debt is eating away at your freedom and power and utilizing compound interest against you. That’s the last thing you want. You need your money to work for you when you are building wealth. You want your money to be going toward your financial future so that you can build wealth for generations to come. High-interest debt destroys that.

But not all debt is the same. For example, mortgage debt with a low interest rate is no problem. Why? Because that’s something where you can make more money investing in the housing market then you can make paying down your mortgage. Once you free yourself from debt, you’ll be able to put cash toward wealth building every single month.

Do people that invest real estate have more stability and the upper hand on wealth building?

I am going to start this conversation out with a quote from an article focused on building generational wealth. The article explains the value of saving money at a young age so that you can take advantage of compounding interest. Then the author goes into real estate investing and the crucial role homeownership plays in the wealth equation.

“A 2020 study showed that the average net worth of a homeowner is roughly $200,000. This is 40X greater than the average renter’s net worth of $5,000. We can debate the merits of this study (done by a real estate association of course) all day long (demographic sampling, housing price changes, etc). However, the point is, “above average” people generally all own homes and are wealthier, be it 2X wealthier or 40X wealthier than the average renter.” -Sam Dogen

Sam talks about the “above average” person and their saving habits. He summarizes the “above average” person with these common traits:

- Has an education and had good grades and a strong work ethic.

- Does not spend more than they make.

- Intentionally saves for the future knowing at some point they won’t be willing/able to work.

- Takes responsibility for their behaviors.

- Takes actions to use resources such as tracking their spending, managing a budget, reading financial resources, and listing to market trends.

- Welcomes constructive criticism and not overly sensitive to change. Keeping an open mind is critical.

- Has a healthy amount of self-esteem to be able to lead change and better themselves.

- Enjoys empowering themselves in others in learning through books, blogs, magazines, seminars, and continuing education.

Why is important? Because being self-reflected and self-aware is an important part of embarking on your wealth building journey. Being 25 or younger gives you a huge competitive advantage to allow for compounding interest to work its magic. Let’s discus the role that property ownership has in this equation.

There is a reason why 97% of millionaires are property owners. “The return on rent is always zero. You get a place to live and that’s it. There is never a positive return on an asset after a month, or 30 years of renting. A renter cannot pass on her paid off house to her kids or grandchildren. There is no asset accumulation at all. There is a reason why some 97% of millionaires are property owners. If you are 25 years old, your mission should be to try and find a stable job and get neutral real estate by owning your primary residence. If you rent, you are trying to SHORT the real estate market, which is unwise long-term.” -Sam Dogen

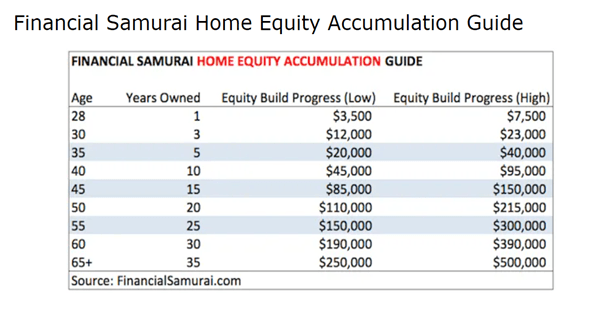

You need to spend less than you earn for that inevitable day you no longer have an income. You also need to live somewhere, hence, you should own your property if you know you will be there for much longer than 5-10 years. Here’s a chart below that outlines how owning property contributes to your net worth:

By the time a 27-year-old pays off his or her mortgage in 30 years, they will be 57 years old with a place to live or rent out for the rest of their life. That is the true value of the property, the rent saved for the remainder of the owner’s life. Home prices have historically returned just a bit above inflation every year 2-3%. When you add on the tax benefits for mortgage interest deduction and owning a home through a mortgage becomes very beneficial. Besides just owning your home there are plenty of other ways to invest in the housing market.

Additional real estate investment strategies:

- Investment Properties. This is one of the more obvious ways to make money in real estate. You purchase a property with a mortgage loan and then you rent the property to long-term tenants for more than your mortgage payments. Then you are accomplishing two things: a, you now have passive income each month with the rent, and b, you can sell the property down the line for whatever equity you tenants paid.

- Real Estate Investment Trusts. These are known as “REITS” they are a special type of company designed to invest in real estate assets without owning them. They are like a stock market version of real estate investing.

- Fix-and-Flips. This strategy is basically what HGTV was built off. You find a property in an area with growth potential. You fix the thing up and then you sell it for $20,000 more than what you bought it + put into it. It sounds simple but there is a lot of planning a strategy that goes into financing flips and unforeseen costs.

- Wholesaling. This tactic is known as the middleman between motivated home sellers and investors. A wholesaler finds a cheap property and then connects them with an investor. They are often known for their “we buy houses” signs you’ve probably seen around town.

- Crowdfunding. This is a relatively new form of real estate investing. There can certainly be a lot of money made. When a professional developer sees an opportunity to create a giant money generating building, they ask investors for millions of dollars to build it. They run the profits and project when the investors will have their money back and then some. It can be risky but oh so profitable.

Either way, investing in yourself is the first place to start. Dig into a book, podcast, or article and begin teaching yourself what opportunities are out there. Take control of your finances before it’s too late. Your family and free time later in life will thank you.

Sources and Reading Recommendations:

Articles:

· “What Should My Net Worth Be At Age 25?” by Sam Dogen

o https://www.financialsamurai.com/what-should-my-net-worth-be-at-age-25/

o https://www.financialsamurai.com/about/

· “The Complete Guide for Investors” -By Charles Mburugu

o https://www.mashvisor.com/blog/net-zero-homes-guide/

Books:

· “Quit Like a Millionaire” by Kristy Shen & Bryce Leung

o https://www.amazon.com/Quit-Like-Millionaire-Gimmicks-Required/dp/0525538690

· “The Millionaire Next Door” by Thomas J. Stanley & William Danko

o https://www.amazon.com/Millionaire-Next-Door-Surprising-Americas/dp/1589795474

· “The Automatic Millionaire Homeowner: A powerful Plan to Finish Rich in Real Estate” by David Bach

o https://www.goodreads.com/book/show/622.The_Automatic_Millionaire_Homeowner

Podcasts:

· “The Person Finance Podcast” by Andrew Giancola

o https://www.thepersonalfinancepodcast.com/

· “Bigger Pockets Real Estate Podcast” by Scott Trench

o https://www.biggerpockets.com/blog/category/biggerpockets-podcast

About the Author

Recent Posts

Let's Stay Connected

Follow us on and become part of the PREC community

Never miss a tweet by connecting with us on Twitter

Check our our posts about trends in real estate industry and market