Should We Really Be Freaking Out at a 6% Interest Rate?

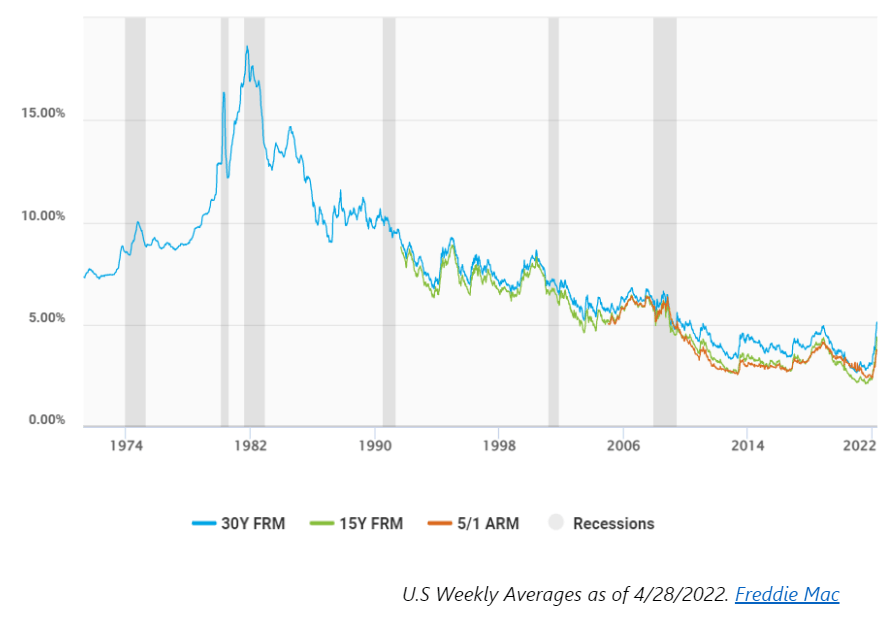

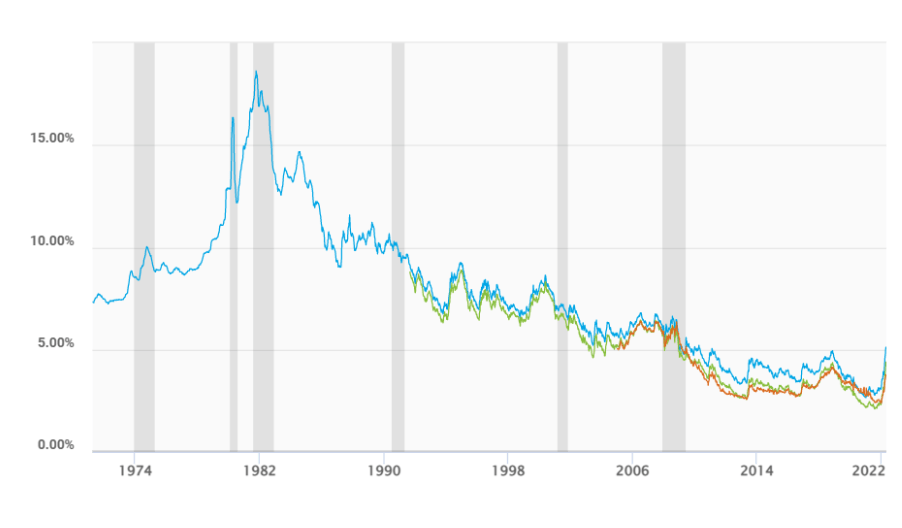

The American dream has always included a house, but with the rise in interest rates you may be asking yourself “is now the time to buy”? According to NerdWallet the average 30-year fixed-rate mortgage (FRM) as of May 3, 2022, has an interest rate of 5.272%. Throughout the Covid-19 pandemic, we’ve watched mortgage rates fall to a historical low. In fact, according to Freddie Mac, the lowest mortgage rates on record occurred in December 2020, with a 30-year FMR loan at 2.68% interest. Now, we are seeing the expected rise in interest rates as buyers are flooding the market and property is scarce. The current rise in rates may be concerning to homebuyers who are beginning their house hunting journey, however, if you look back on past interest rates, you will see that at our current rate between 5 and 6% for an FMR is considered relatively low.

The graph above shows the weekly mortgage rates from 1970-2022. When analyzing the graph, you will notice that our current rates are significantly lower than a majority of past rates. In November of 1981 rates hit an all-time high, which is substantially more than any rates we have seen in the last 10 years. So, when faced with the question “should I buy right now?” you can reflect on our country’s historical interest rates. Let’s take a closer look at the rise and fall of mortgage rates over the last 50 years.

1970’s

The New York Times article, Mortgage Rate at 8.5% (in 1970), it’s stated that the average home interest rate was 8.5% and the average monthly payment for a home was $126.88. Rates began near 7% in 1970 and by the end of the decade rose to almost 13%.

1980’s

With inflation and unemployment rates at a high, the American people were faced with the Great Inflation. The home prices rose from an average of $23,100 in 1970 to $56,910 in 1980. At the start of 1980 interest rates averaged 7%. Over the next 10-years rates skyrocketed up to 18.37% in 1981 and dipped down to 9.75% as U.S. citizens recovered from the Great Inflation at the end of the decade.

1990’s

The rise and fall of interest rates slowed down during this decade as inflation began to steady. In January of 1990 FRM rates were at 9.8% and fell to 7.42% by the end of 1999. The Economic Policy Institute published an article discussing the growth of the 90’s. During this decade we saw the rise of the internet, helping to create a productivity boom. As a result, inflation declined, and the economy grew.

2000’s

Interest rates began near 8% and fell to an average of 5% by 2009. This decade faced a crash in the housing market due to property value decline. Many homeowners were faced with owing more on their home than the property was worth. Eventually the Federal Reserve cut interest rates, resulting in their decline to nearly 5% at the end of the decade.

2010’s and On

At the beginning of 2010, mortgage rates were approximately 5% and by 2020 rates were under 4%. In 2019, just before the pandemic, interest rates had dropped down to 3.7%, reflective of the rates in 2013. As Covid 19 spread, mortgage rates continued to drop to encourage people to borrow money for home loans. That brings us to today, where we are seeing mortgage rates begin to rise due to a lack of properties and a surplus of buyers. However, even though rates are rising, we continue to see low rates at between 5 and 6%.

When you reflect on the data provided from Freddie Mac, you may notice a trend in interest rates over the years. As of now Freddie Mac predicts that we will face a decline in demand for properties, which would result in a reduction of home price growth. They predict that later this year interest rates will be moved at a more sustainable pace, resulting in a slower growth of interest rates. With this information in mind, it is possible to make a solid prediction that now might not be a bad time to buy despite our historically low FMRs of the past few years. We have all heard the saying “history repeats itself;” use this saying to guide you as you reflect on our nation’s past trends and the future ahead.

About the Author

Meet Hannah McArdle. Hannah has a background in child development, elementary education, and instructional design. She attended Eastern Kentucky University, earning a Bachelor of Science in Elementary Education. She went on to work with children in a variety of capacities as she pursued her Master of Education in Learning and Technology. After receiving the opportunity to teach 1st grade, Hannah relocated to the east coast of Virginia. While there, she began to yearn for the hills of her former home, Kentucky. She packed her bags once again, this time finding her home at PREC. She is excited for her new journey and hopes to become a Real Estate guru as she earns her Kentucky Real Estate License.

Recent Posts

Let's Stay Connected

Follow us on and become part of the PREC community

Never miss a tweet by connecting with us on Twitter

Check our our posts about trends in real estate industry and market