Meet John Tallarigo. John is the education content developer and is working on expanding PREC coursework into new states and additional courses for our current states. His interest in property law led him to get his real estate license while studying for the bar exam! John is a graduate of NKU Chase College of Law '16 and earned his undergraduate degree from Northern Kentucky University '11. He loves the Cincinnati Bengals!

Loan Assistance Programs and Government Grants

Here I am, two years after that thing that happened in 2020. I’m back in the office, vaccinated, and working hard. Now I’m finally ready to start looking at buying a house.

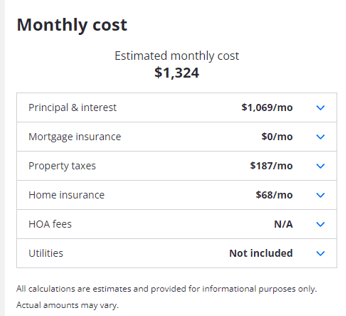

I’ve been looking at Zillow for about 3 months checking on the number of listings coming up each day, wondering if that Zestimate is accurate, and playing with Zillow monthly cost estimating tool to see what kind of monthly payment I would have with my anticipated down payment. And based on the prices in my area, I probably won’t have enough for a 20% down payment for a year or more!

Like many of your first-time buyer clients, I’m sick of my small apartment and need a little more elbow room. Considering that 2023 may be a worse time to buy with increased interest rates, I’m still thinking I can do it. Every day I’m seeing prices drop, better looking houses fall into my price range, and listings staying on the market longer. But before I buy something, I can’t just guess what my price range is. I can’t just guestimate what I can afford for a down payment; I need to know. And part of knowing is understanding what kind of loan programs are out there.

Common Loan Programs:

The most common type of government loan is an FHA loan, or Fair Housing Administration loan. If someone cannot afford a traditional 20% down payment, they are most likely going to do a FHA loan with a variable down payment. The minimum down payment for this loan is 3.5%, requires a minimum credit score, and requires mortgage insurance as well. There is also a cap on the maximum loan amount that will vary by area and there is no income cap for eligibility.

Veterans and active service members of the military are eligible to obtain mortgage assistance from the U.S. Department of Veterans Affairs (the VA) in the form of a VA loan. This loan does not require a minimum credit score, a down payment, and does not cap the loan amount or the applicant’s income to be eligible.

The USDA loan program was designed by the U.S. Department of Agriculture (USDA) to assist low- to moderate-income households with the purchase of homes in rural areas. The better your credit score, the more likely to be approved for a USDA loan. This program does have some income limitations based on their household size and property location.

The Good Neighbor Next Door HUD program benefits public service workers by allowing a purchase of a home at a 50% discount. Applicant’s must commit to staying in the home for 3 years and must be either Law enforcement officers, teachers (pre-Kindergarten through 12th grade) firefighters, or emergency medical technicians.

There are also conventional home lenders that offer similar programs established by Fannie Mae and Freddie Mac. The Home Possible program allows first time home buyers to finance a home purchase with only a 3% down payment so long as they have a credit score of 660 and attend a home ownership class. These programs do have income caps and require mortgage insurance as well.

State Loan Programs:

There are also a ton of local loan assistance programs run by the state your buyers live in. The local HUD offices offers programs that vary from state to state and county to county. Since I’m buying in Kentucky, I’ll include some Kentucky examples. HUD has a community development block grants for home buyers in Ashland, Lexington, Louisville, and a few other larger communities in KY. There is also the HUD HOME Program for other low- to very-low income, smaller communities in Kentucky.

Down Payment Assistance Programs:

In addition to loan assistance and loan grants, your buyer clients may also want to consider down payment assistance. The more money they can put as part of a down payment, the less the loan principal will be, and the more money they will save in the long run. States and even city municipalities may offer up to $10,000 in a down payment loan. And these also may be available through the bank, other government agencies, local non-profits like the Kentucky Housing Corporation, and even employers.

So here are the big take-aways that I’m going to keep in mind as I start applying for financing and hopefully purchasing a house in the next few months. There are tons of financing options for first time home buyers. Don’t stop at the first page of google. Talk with a local lender and then talk with another, and possibly another, to get as many options as possible. Oh man, I’m excited for my first house, but not for all that financing paperwork! And if you need help preparing for your first-time home buyer, give us a call!

About the Author

Recent Posts

Let's Stay Connected

Follow us on and become part of the PREC community

Never miss a tweet by connecting with us on Twitter

Check our our posts about trends in real estate industry and market