Meet Hannah McArdle. Hannah has a background in child development, elementary education, and instructional design. She attended Eastern Kentucky University, earning a Bachelor of Science in Elementary Education. She went on to work with children in a variety of capacities as she pursued her Master of Education in Learning and Technology.

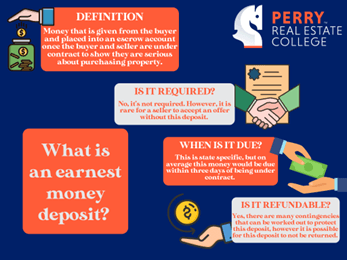

Earnest Money: What I Should Know.

During the home buying process, you will undoubtedly come across the term earnest money (I know what you’re thinking, this does not have anything to do with everyone’s favorite 80’s/90’s character, Ernest P. Worrell.)

Sometimes referred to as a good faith deposit, this money is used as a deposit to demonstrate your sincerity about buying a property. When you sign the purchase agreement or sales contract, you deliver the specified amount of money to be placed in an escrow account. This money is typically used at closing toward the purchase of the property.

Earnest money is technically not required, however with the current state of the housing market, be prepared to include this to strengthen your offer! Check out our blog Contract Pending: Real Estate to learn where earnest money fits into the timeline of the home buying process.

Why Do I Need This?

The thought of putting money down that could potentially be lost, which is true for nearly any deposit, can cause a feeling of apprehension. However, I challenge you to put yourself in the shoes of the seller. Imagine deciding to sell your most prized and expensive possession. Someone shows interest; they offer you over your asking price and you accept!

Now imagine the person buying your home decides they no longer want to buy your property because they found one, they have a stronger interest in.

Now, if you’ve ever bought or sold a property, you know that the closing process doesn’t happen overnight. So, you could possibly be a month or more into the process when the buyer drops out. At that point, the process would start over again, meaning more mortgage payments and possibly a delay on when the seller can purchase a new home.

If there had been an earnest money deposit in this transaction, the buyer would lose their deposit. This deposit adds an incentive to only make an offer on a property you intend to buy. As a seller, assurance that the buyer intends on following through with the home buying process, adds a sense of security to this anxiety-inducing process.

While there are considerations for having the deposit refunded (e.g., an unsatisfactory inspection report, a property doesn’t appraise at an adequate price, buyer’s financing falls through), they do not cover someone backing out because they “feel like it.” Adding earnest money to an offer strengthens it, showing a buyer’s seriousness to purchase the property and adding some security to the contract.

There is no set amount of earnest money that you are required by law to put down for each purchase transaction.

How Much Earnest Money Do I Need?

The amount of your earnest money deposit will depend on the purchase price. Typically, earnest money is between 1% and 2% of the purchase price. We all know money talks, so increasing your deposit above the average amount sends a message to the seller that you mean business! In our current hot market, where sellers are heavily in favor, presenting your best offer will significantly increase your chance of having an offer accepted.

When determining how much money you’d like to offer, your real estate agent is your best resource! Your agent will know what trends are happening in your area and what constitutes a strong offer. A good agent will also make sure to put contingencies in your purchase contract that protect your money within reason. It is unlikely that you will lose this deposit, however it is a good idea to find just the right amount that shows the seller you are serious, while also thinking about reducing financial risk for yourself.

About the Author

Recent Posts

Let's Stay Connected

Follow us on and become part of the PREC community

Never miss a tweet by connecting with us on Twitter

Check our our posts about trends in real estate industry and market