Gabbi knew that real estate was the right career from the start. She is now dual licensed in both Kentucky and Ohio. She had her first sale within a month of getting licensed and hit her first million in volume within her first 6 months. She will have her real estate license for the rest of her life. Call her anytime if you have questions about becoming a real estate agent. She loves to share her passion for real estate with others!

Buying an Investment Property?

Here are 5 of Canada's Top Cities for Rentals

Buying an Investment Property? Here are 5 of Canada’s Top Cities for Rentals. Real estate has produced some of the world’s wealthiest people. Unlike stock investment, real estate investment (almost) always surges in the long run. So it’s a pretty good decision to invest in real estate.

Buying an investment property, such as a rental property, is a dream of many. Investors dive in to make some healthy cash inflow (possibly an extra layer of income). But what they often forget is the cash outflows (such as repairs and maintenance costs). To help you buy a rental property, we have created a list of a few factors investors (like you) need to consider while making the big decision.

Factors to Incorporate When Buying a Rental Property

Since you’re buying a rental property, I’m assuming you already own a principal home. Buying a rental home is somewhat similar to buying your first home. But their purpose is way too different.

So when you’re buying an investment house, you need to be extra careful, as that’s your key source of income and generating profits over the resale.

Pay Off Your Debts

Just like buying your first home, make sure you pay your debts first. Once you have nothing on your debt list, mortgage lenders would feel delighted to lend you money (after all, they are also doing a business to make money).

Secure Down Payment

Securing down payment for a rental property is slightly different than that required for the primary house. Lenders might ask you to deposit 20% as a down payment. Here you could think of securing down payment via a personal loan.

Maintenance and Repair Costs

While you won’t live in that new house, you may have to pay some repair and maintenance costs. These costs could include costs to paint, roof repairing costs, buying appliances, etc.

Calculate Your Margins

Some experts suggest an annual return (after interest and tax) of at least 5% of the total value of the property. So if you buy a house for $500,000, your return should be close to $25,000 p.a.

Choosing the Location

You don’t have much choice in selecting the best location when buying your primary home. But you have it when buying an investment property.

It’s interesting to state that the housing market moves very differently in various parts of the country. Sometimes the most expensive areas give you a lower return.

That brings us to the next section - choosing the best city with the highest rentals. We have some interesting stats here with Canada’s best cities in terms of the highest rentals.

Canada’s Top 5 Cities to Invest in Rental Properties

With nearly 1,137 cities and towns in Canada, only a few are counted as the country’s best places to invest in rental properties. We have highlighted only the top five cities here.

Note: these cities keep on changing their positions month-over-month. Do consult real estate professionals near you before making an investment decision.

Vancouver, BC

Vancouver has been at the top of the list for the past few months. In June 2021, the median rental prices for one-bedroom and two-bedroom homes were $1,950 and $2,730, respectively. And in July 2021, the rental price increased by 2.6% to reach $2,000 for a one-bedroom house and $2,800 for a two-bedroom house. That’s a pretty good rental income if you think of buying an investment property in Vancouver.

Burnaby, BC

In June 2021, Toronto stood at number two with the highest rental value. In the next month, it dropped to number four, while Burnaby replaced that position.

In July, the median rental value for a one-bedroom house was $1,750, with month-over-month growth of 2.9%. While it was $2,280 for a two-bedroom house in the same month, witnessing a slight increase of 0.4% compared to June 2021.

Barrie, ON

At number three, we have Barrie with $1,730 for a single-bed home and $1,920 for a home with two bedrooms. The month-over-month hike was 4.8% and 4.9%, respectively.

Toronto, ON

Interestingly, Toronto, the capital of Ontario, witnessed a drop in median rental prices. In July, the rental for a one-bedroom house was $1,710 and $2,200 for a home with two beds. Toronto also witnessed a drop in rentals back in March this year. While it doesn’t seem good for investors, it’s a moment of joy for new tenants.

Victoria, BC

Victoria, like Vancouver, maintained its position and showed a stable rental market.

The closing rental for a one-bedroom house in July was $1,670, a growth of nearly 4.4%. On the other hand, the rental for a two-bedroom house in the same month reached $2,080, an increase of only 0.5%.

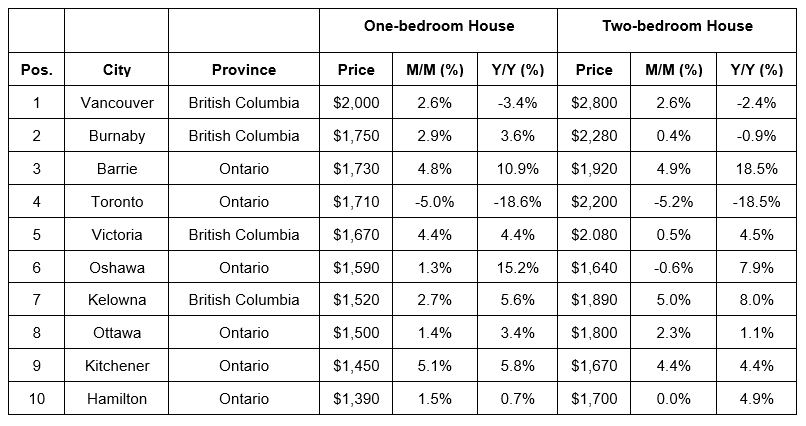

Canada’s Top 10 Cities to Invest in Rental Properties (Bonus)

If the top five cities don’t grab your attention, this list of Canada’s top ten cities with the highest rentals might.

Speak to an Industry Expert

Recent Posts

Let's Stay Connected

Follow us on and become part of the PREC community

Never miss a tweet by connecting with us on Twitter

Check our our posts about trends in real estate industry and market