How to Buy a Home in Ohio: A Step-by-Step Guide

Buying a home is one of the biggest financial decisions you will ever make—and if you are doing it in Ohio, you are in luck. With affordable home prices, diverse neighborhoods, and strong communities, Ohio offers a great environment for homeowners.

Whether you are a first-time buyer or moving within the state, this step-by-step guide will walk you through everything you need to know about buying a home in Ohio—from pre-approval to move-in day.

Step 1: Understand Your Financial Situation

Before browsing listings or attending open houses, take a good look at your finances:

- Check your credit score. Most lenders require at least a 620 for a conventional loan.

- Calculate your budget. Experts recommend spending no more than 28% of your monthly income on housing.

- Save for a down payment. You will need at least 3%–5% of the home’s price, though 20% can help you avoid mortgage insurance.

- Set aside funds for closing costs, typically 2%–5% of the purchase price.

Tip: Use a mortgage calculator to estimate your monthly payments.

Step 2: Get Pre-Approved for a Mortgage

A mortgage pre-approval tells sellers you are serious—and it gives you a clear budget. Shop around with banks, credit unions, or mortgage brokers to find the best loan terms. During this process, you will provide:

- Income verification

- Tax returns

- Bank statements

- Employment information

Once approved, you will receive a pre-approval letter to submit with your offers.

Step 3: Hire a Real Estate Agent

An experienced Ohio real estate agent is your best ally in this process. They will help you:

- Navigate the local market

- Schedule showings

- Draft and negotiate offers

- Manage paperwork and deadlines

Choose an agent who knows your target area—whether it is downtown Columbus, the suburbs of Cincinnati, or rural Northeast Ohio.

Step 4: Start House Hunting

Now the fun begins. Make a list of your priorities:

- How many bedrooms and bathrooms?

- What kind of yard or property size do you need?

- Which school district or neighborhood suits you best?

Your agent will send listings and schedule tours. Take your time and do not be afraid to ask questions during showings.

Step 5: Make an Offer

Found your dream home? Your agent will help you prepare an offer that includes:

- Purchase price

- Contingencies (inspection, financing, appraisal, etc.)

- Closing date

In competitive markets, be prepared to act fast. You might need to offer above asking price or make other concessions.

Step 6: Home Inspection and Appraisal

Once your offer is accepted:

- Hire a licensed home inspector. Ohio is a "buyer beware" state, meaning it is your responsibility to uncover potential issues.

- Schedule an appraisal. Your lender will require this to ensure the home is worth the loan amount.

If serious problems are found, you can renegotiate or back out based on your contract terms.

Step 7: Secure Final Loan Approval

Submit any final documents to your lender for underwriting. Once approved, you will receive a Closing Disclosure outlining all fees and loan terms. Review it carefully before signing.

Step 8: Final Walkthrough

A day or two before closing, walk through the property to ensure:

- Repairs have been completed

- The home is in agreed-upon condition

- Nothing has been removed that should stay

Step 9: Close the Deal

On closing day:

- Review and sign the final paperwork

- Pay your down payment and closing costs

- Get the keys once the transaction is recorded

Congratulations—you are now a homeowner in Ohio!

Bonus: First-Time Buyer Programs in Ohio

The Ohio Housing Finance Agency (OHFA) offers:

- Down payment assistance

- Low-interest loans

- Tax credit programs

Be sure to check if you qualify for state or local grants that can make buying your first home more affordable.

Buying a home in Ohio does not have to be overwhelming. With the right preparation, a great real estate agent, and a solid understanding of the process, you will be unlocking the door to your new home in no time.

Thinking about buying in Ohio? Let me know if you would like a personalized homebuying checklist or help connecting with local lenders and inspectors!

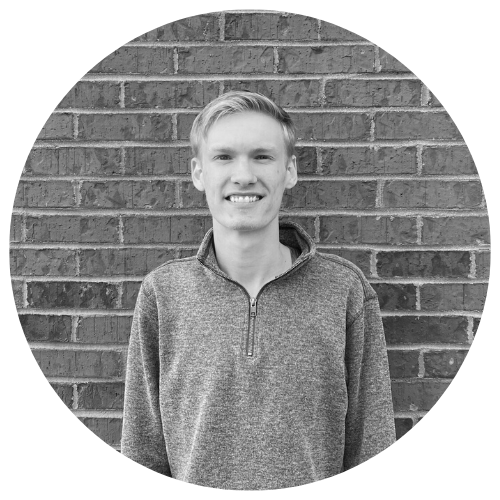

Meet Richard!

Meet Richard White! Richard is the person to go to whenever you have any questions about your course or the process of obtaining your real estate license.

Recent Posts

Let's Stay Connected

Follow us on and become part of the PREC community

Never miss a tweet by connecting with us on Twitter

Check our our posts about trends in real estate industry and market