Gabbi knew that real estate was the right career from the start. She is now dual licensed in both Kentucky and Ohio. She had her first sale within a month of getting licensed and hit her first million in sales volume within her first 6 months. She will have her real estate license for the rest of her life. Call her anytime if you have questions about becoming a real estate agent. She loves to share her passion for real estate with others!

What is the RPR Tool and How Do I Use It to Create an Investor Analysis?

The RPR, or the Realtors Property Resource, is a tool that is accessible to agents to use within the MLS. It’s a fantastic tool that real estate agents can use to create digestible reports for themselves or their clients.

Reports you can create using RPR:

- Create a CMA (Comparative Market Analysis)

- Create an Investor Analysis Report

- Target Opportunity Zones

- Create a Seller’s Report

- Create a quick Market Overview

If you have not read our first article breaking down how to create a CMA report using RPR, click here to read that blog post. Today we are going to walk you through how to create an Investor Analysis Report (IAR) using the Realtors Property Resource tool in the MLS. If you are a visual learner there are video demonstrations on the RPR webpage. If you go to the main page on the RPR website and scroll to the bottom right, you will find a button that says “RPR Learning.” It’s going to look like this.

Use this library of workshops and webinars to guide you as you begin learning how to use the RPR tool. Click here to go the RPR workshop webpage. For today’s example we are going to be using a distressed subject property that is currently listed in the MLS in Newport, Kentucky. Subject property: 411 E 3rd Street Newport, Kentucky 41071. The interior of this home stripped down to the studs, but we are going to use the RPR tool to create an Investor Analysis Report (IAR) so that we can determine the After Repair Value (ARV.)

Subject Property Basic Home Facts:

- List price: $275,000

- Type: singly family

- Bedrooms: 3

- Bathrooms: 2

- Square footage: 2500

- Lot square footage: 3572

Follow these steps to create an Investor Analysis Report:

- Step 1: Use the search tool at the top of the main webpage on the RPR website to find your subject property.

- Step 2: Scroll down to “Additional Resources” and click the “Valuate” tool.

- Step 3: Fill in the following prompts.

- Flip or long-term hold: Flip

- Full year holding costs: $30,336 (You can calculate this by calculating how much you’re putting down to get your estimated monthly payment and then multiply that by 12.)

- Purchase price: $215,000 (I am evaluating the subject property using a value that is under the asking price because I wouldn’t pay $275,000 for this house.)

- Loan to value percentage: 92.85%

- Repair budget: $150,000

- Loan Amount: $335,691

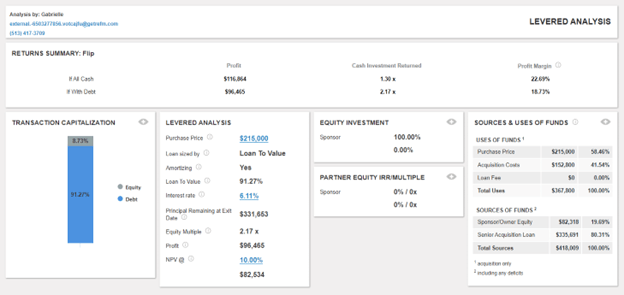

- Step 4: View your report. Click on the “Levered Analysis Tab” at the top of the page and you should get a report that looks like this.

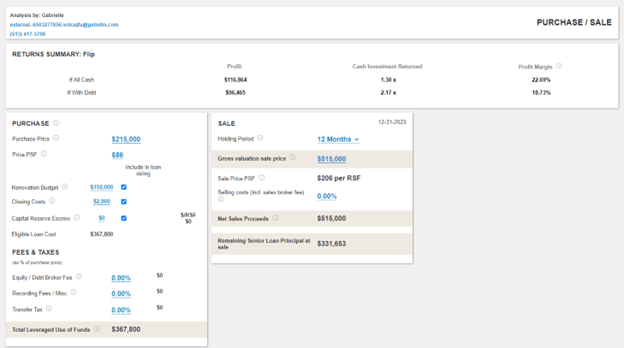

- Step 5: Next you’ll want to click the “Purchase/Sale” tab to see your final results.

The point of this tool is to go above and beyond to show your client that they are in good hands. The reports you send to your clients should be as professional as you are! Let us know if this is helpful and check back to the Career Corner for other RPR tool break downs.

About the Author

Recent Posts

Let's Stay Connected

Follow us on and become part of the PREC community

Never miss a tweet by connecting with us on Twitter

Check our our posts about trends in real estate industry and market